Time Is Running Out As National Debt Clock Ticks Away [Opinion]

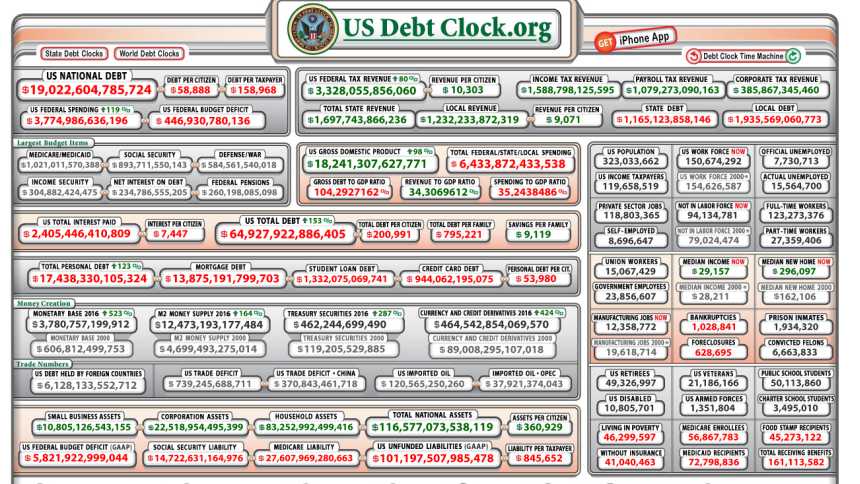

I found it a bit ironic that right about the time people were heading to the first vote of the 2016 presidential election in Iowa, our country’s debt crossed a dubious milestone, barreling past the $19 trillion mark. In 2009, I wrote a debt-related column called “On The Edge Of A Cliff.” Back then, the debt was just crossing the $10 trillion mark. In 2013, I wrote another column called “From A Fiscal Cliff To A Hole.” When I wrote that column, we were in the $16 trillion range.

I found it a bit ironic that right about the time people were heading to the first vote of the 2016 presidential election in Iowa, our country’s debt crossed a dubious milestone, barreling past the $19 trillion mark. In 2009, I wrote a debt-related column called “On The Edge Of A Cliff.” Back then, the debt was just crossing the $10 trillion mark. In 2013, I wrote another column called “From A Fiscal Cliff To A Hole.” When I wrote that column, we were in the $16 trillion range.

As the election season unfolds, I have not yet fully decided where my presidential vote will go. But, I am disappointed the presidential candidates are not making much of an issue of the debt other than window dressing in speeches and debates.

Right now, your portion of the national debt (and your children’s) is nearly $60,000 — that is everybody in the country. This is a serious issue that deserves serious attention from those seeking our support to lead the country.

So, why is the debt not getting the attention it deserves? It could be the media’s fault. They are more interested in who insulted who and the endless analysis of polls, which have nothing to do with where the candidates stand. Or could it be our fault, because we give the media ratings by watching or reading when they treat presidential politics more like wrestling than the important process of selecting the most qualified man or women for the job?

Washington, DC, and all who inhabit it certainly carry some of the blame. Many elected officials are more than happy to kick the can down the road, knowing calamity likely won’t happen on their watch. But, a calamity surely will occur if we don’t address the debt. If you don’t believe me it is a disaster in waiting, just go to USdebtClock.org and watch the real-time ticker roll for a few minutes. It takes just a little more than one minute to add another $1 million to what we owe.

Already our debt has surpassed our annual GDP, which is just a little more than $18 trillion. That puts the debt at about 104% of GDP.

I remember some economists saying that’s when a red flag should go up. Yet, the ticker continues to roll. What will be the next “hair-on-fire” milepost we will fly by and ignore? Will it be when the service on the debt becomes greater than our annual federal tax revenue?

Luckily, we are long way off from that, at least for the time being. Right now, our net interest on the debt is about $233 billion annually. It is just money that evaporates into nothing.

When you have a major candidate for president on one side promising free everything and a leading candidate on the other side suggesting it is economically feasible to find, forcibly remove, and then turn around and reprocess undocumented immigrants back into the U.S., we are on a fast train to nowhere.

Economists love to talk about the “black swan” event that can turn economies upside down here in America and globally. It is the unexpected event no one predicts. The 9/11attack and the 2008 meltdown were black swans. Not many economists are warning our debt itself could be a black swan yet. That’s good news and means we have time to correct our course, but will we?

Our leaders and our people have not dealt with the national debt because it is hard and will require unpopular choices. Just look at our individual personal debt in America — it is $17.5 trillion. Nobody seems to be taking this seriously. But, one day, one way or the other, the debt will deal with us. The ticker is rolling.