Fruitful Prospects Continue To Flourish for Berry Growers Today

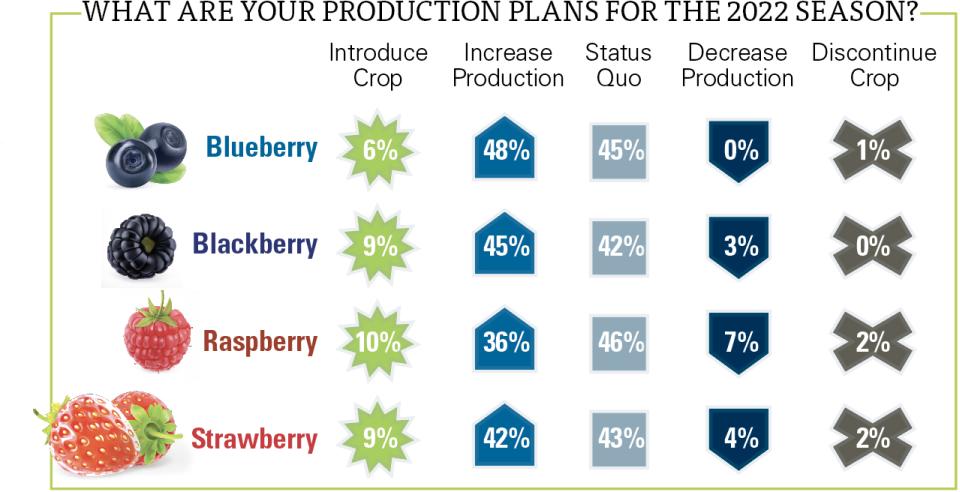

A prominent produce buyer, in a memorable speech a few years ago, said if he were a fruit grower, he would plant blackberries. Growers responding to American Fruit Grower’s annual State of the Industry survey may have taken such advice to heart, as blackberries are among the crops cited most often as a crop they plan to introduce this year.

Though it must be noted it was basically a dead heat, as two other crops topped the list of newly planted crops. Amazingly — or not so amazing when you consider consumers’ preference for the tasty superfoods that pack a bunch of healthy antioxidants — both the other crops are also berries: raspberries and strawberries.

As might be expected, the optimism extends to current berry growers’ plans for expansion of planting this coming year, although an equal number are taking a wait-and-see attitude. About half the growers plan to expand, while half are standing pat, with just 3% pulling back on production.

It should be noted that unlike many fruit crops, berries are grown all over the U.S., as even those states without heavy commercial production will often have extensive U-pick and other, often quite large, direct-market operations.

NATIONAL PERSPECTIVE

Our survey respondents reflect more of this national outlook, with more of these direct-market, smaller-acreage growers representing a preponderance of the responses. In other words, the Pacific Northwest (PNW), which is home to the nation’s heaviest berry production, is not proportionally weighted.

PNW growers had their toughest struggle with the 2021 crops as they have with any in several years, as a smothering heat dome settled over the region in late June, smashing records with temperatures well over 100°F. Here is a typical comment from a Washington grower about the heat: “[We had] a third-quarter loss of 25% due to extreme heat.”

The rest of the nation, including the other two states in the big four of blueberry production — Georgia and Michigan — also had their struggles but in the main fared much better than the PNW. It was certainly reflected in the surveys, as growers were generally much more positive.

However, growers outside the PNW also had their own weather problems, especially unseasonable heat or cold waves and heavy rains. Besides weather, the most commonly reported problems are the now-typical reports of spotted wing drosophila and increases in prices of inputs, shipping, and diesel fuel.

SHOW ME THE MONEY

Growers are obviously upbeat about berries, so what are they doing to increase profits? That largely depends on the size of the grower, as might be expected. However, one simple strategy dominates — no matter what the size of the grower — raise prices.

Many of the growers’ responses reflect that they had no choice. This is a typical response: “We had to raise prices,” one grower writes. “Costs keep going up.”

Other tactics to improve profits are more tailored to the size of the grower.

For example, larger berry growers repeatedly emphasize an increasing reliance on mechanization to reduce their labor costs. Berry harvesters, specifically, are frequently mentioned, along with streamlining and updating sorting and packing capabilities.

Smaller growers took advantage of the fact many people have sought out locally grown fruits during the COVID-19 pandemic, so they tried to take advantage of that. For example, one grower reported going to a farmers’ market for the first time.

Some decided to go into pick-your-own (PYO) for the first time. Others changed their PYO procedures, such as charging a flat fee per bucket rather than by the pound. Still other PYO growers want to ensure they’re not getting taken of advantage of

by customers.

“[We] charge a minimum for berry pickers over a certain age,” one PYO grower says.