It’s Full Steam Ahead for Nut Growers in California

Nut growers are definitely an optimistic lot. If you review the comments of growers of the big three tree nuts — almonds, walnuts, and pistachios — from American Fruit Grower’s annual State of the Industry survey, you would think growers are hunkering down, licking their wounds from increases in prices and shortages of all sorts of inputs, not to mention water and labor shortages.

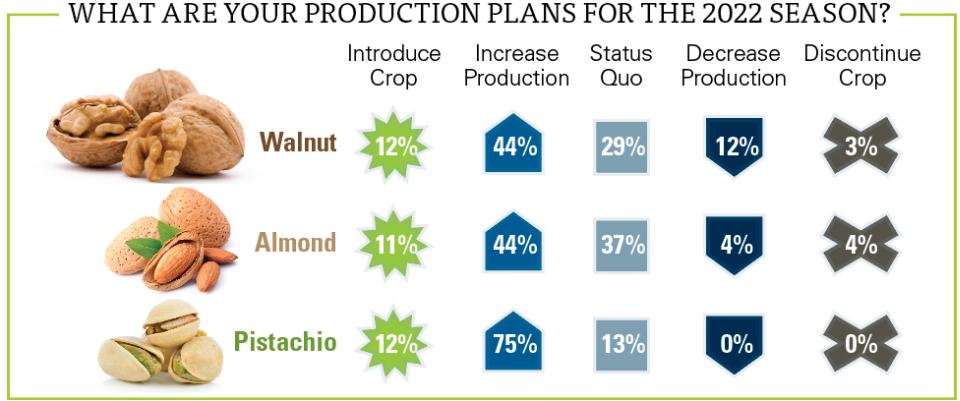

But rather than bide their time, a majority of growers plan to expand production this year. On average for all nut crops, 62% plan to increase production, with 32% standing pat, and just 5% planning to decrease production. (Percentages add up to 99% due to rounding.)

What’s remarkable about those strong numbers is almond and walnut prices have floundered, and only pistachios have been faring particularly well the past few years. Another notable fact is that pistachio growers made up a relatively small per-centage of our survey respondents — 15%.

But pistachios’ solid performance has growers in Northern California strongly considering the crop, University of California Extension advisers report. In the past, pistachios were considered a southern crop, with walnuts heavily planted in the north. Almonds are planted all over the Sacramento and San Joaquin valleys.

HANDLING HEADWINDS

The strong production plans are even more remarkable in the face of rising prices and shortages of crop inputs. Especially when you consider how nut growers respond when asked if they have been affected by these buffeting winds and how they have adapted.

Most growers responding to the survey say they would simply cut back on inputs, because they don’t see the prospect of price increases any time soon. But one grower answers at length, fully summing up the situation and citing all the headaches faced by California nut growers these days.

“Our commodity prices are going down, and the inputs, fuel, equipment, etc. are going up,” he writes. “It is an ugly picture; farmers need to have more control of our product prices. Everyone above us does, and they are getting all the profit with no risk. It is not fair. [We are] buying early and cutting back on certain things, [sometimes] not buying the equipment, as it has jumped up in price.

“With regulations, taxes, fees, fuel costs — and the list goes on — they are having a severe impact on agriculture. If the government wants to get rid of Ag in this country, they are on the right track. Parts, filters, etc. are hard to get, and with the government staying on this track it will only get worse.”

Besides all those problems, during the pandemic California growers are facing increasing stockpiles of nuts because of extreme transportation problems. One grower surmised that the key obstacle is “getting our crop to the buyers both domestically and especially exports via container ships. [I’m] very concerned about the prices we are receiving. We are losing money unless we get high production.”

PRODUCTION IS UP

Interestingly, the bullish production plans don’t reflect their reports of this past year’s performance. Production reports for 2021 are all over the place. The two categories most answered, oddly enough, were at the opposite ends of the scale. Production was reported up more than 10% by 30% of the growers, but 19% reported production was down more than 10%. Overall, it was 38% down, 46% up — a mixed bag.

Comments followed suit, with those who did improve profits last year reporting a wide range of strategies, from increasing their prices to eliminating some inputs because of depressed crop values. Other responses included sourcing from multiple chemical companies, better nutrition programs — including moving to foliar application, and removing old blocks of trees and replanting with a different variety at an increased density.

In sum, one theme that kept coming through the responses is an overall concern that with the lack of water storage expansion, restrictive government regulations, and other policies, it doesn’t seem the state of California is as friendly to agriculture as in years past. One grower summed up the sentiments of many respondents:

“California’s continuing practices to favor population expansion at the expense of agriculture, [with] water regs and others adding to the costs of doing business in the state with no real positive outcome.”

Despite that general feeling, the survey demonstrates just how optimistic growers are about this season, as nearly two-thirds are expanding.