Why Nut Prices Have Growers So Dismayed

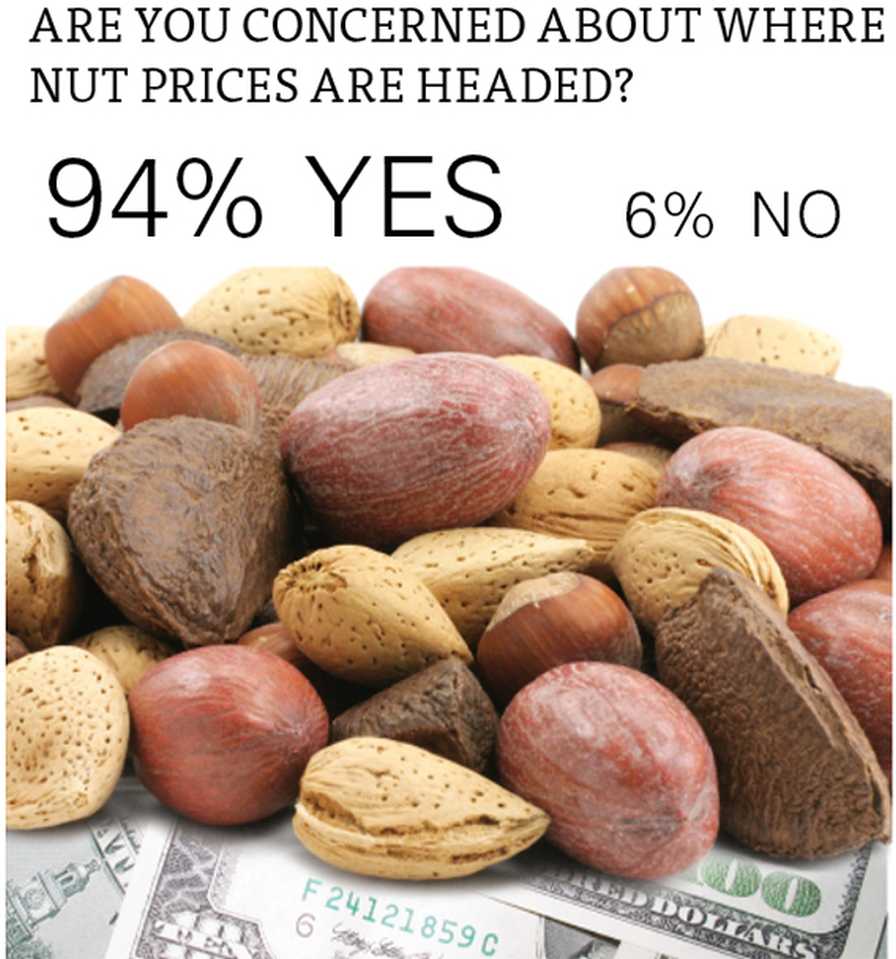

With almond prices sinking below $1.50 per pound this past summer for the first time in a dozen years — and almonds being the dominant U.S. nut crop — growers taking the American Fruit Grower® and Western Fruit Grower® magazines’ 2021 State of the Industry survey were expected to show their concern about where prices were headed. But 94%?

Such huge numbers are rarely seen in answer to any survey question, showing just how high the level of concern is among nut growers. By way of comparison, fewer than half of the growers responding to last year’s survey said they were concerned about where prices were headed, and few of the comments were as downcast as this year.

“We’re anticipating lower prices than seen in the past 20 years, not adjusted for inflation,” says one grower.

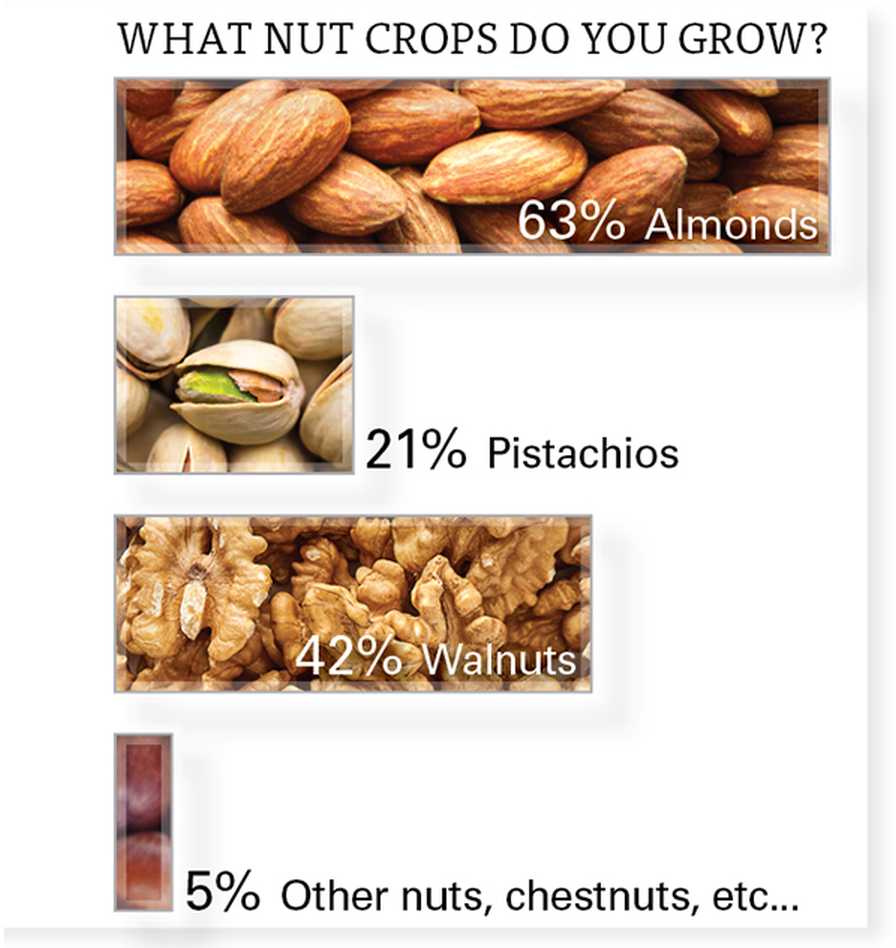

Almond growers comprised 63% of the nut growers taking the survey, making the results more understandable. The next largest bloc was walnut growers at 42%. (The percentages, when added together, exceed 100% because growers often grow more than one nut crop.) Walnut growers, like almond growers, are expecting a record crop this year — 19% larger than the 2019 crop — according to USDA. The bigger walnut crops have understandably brought down prices.

“Because with this very large supply, prices have fallen significantly,” one grower says. “We are nearing our cost of production.”

Another 21% of the nut growers taking the survey grow pistachios. While pistachio growers too will see a record crop this year — likely exceeding 1 billion pounds for the first time — because the crop is severely alternately bearing, the lack of carryover from the previous year helped keep prices stable. This bright light in the pricing scenario was apparently outweighed by the outlook for the other two crops, according to the survey numbers and grower feedback. More than one reported prices are getting to the point that it just wasn’t very profitable.

“Prices are at historically low levels, below the cost of production,” says one grower.

Another factor cited by several growers was the state of exports, which are absolutely critical to the big three nut crops, as the vast majority of the nuts are shipped overseas. Because China instituted retaliatory tariffs in 2018 and 2019, and is such a huge consumer, it was singled out. “China is not importing at the same levels as previous years,” says one grower. Another thought four words would suffice: “China is a customer.”

But it wasn’t just China. The COVID-19 pandemic is global and has hurt the economies of numerous importing countries. Says one grower, summing it up: “Record crops and poor economic conditions in importing countries are depressing prices.”

As for the future, growers don’t sound optimistic coming off such huge crops. Says one grower: “Too many planted acres, and plantings are still increasing.”

Another grower says perhaps nut growers should consider growing additional crops, spreading the risk. “That’s farming,” he says of the concerns about nut prices. “You need diversity.”

One of the few nut growers who expresses no concern about where prices are headed was one who doesn’t grow any of the big three nut crops. Because of that, such factors as exports aren’t a concern. The grower has “small acreage — with a large population who want my chestnuts.”