Specialty Crop Growers Looking for Solutions To Major Labor Pains

USDA’s Economic Research Service (ERS) is taking a closer look at one of the largest issues impacting the produce industry: Labor.

In a recently published report, ERS economists analyzed how fruit and vegetable growers are coping with changing labor cost structures, which includes worker availability and rising wage rates. In addition, researchers looked at how three strategies are adding to their production and management practices.

The following is a snapshot of the report’s highlights and findings.

Strategy 1: Increasing Imports and Decreasing Domestic Production of Crops That Are Not Competitive With Imports

The U.S. is a major producer of fruit and vegetables for both the fresh and processed markets. It is also a major importer of these items. Over the periods spanning 2000-2002 and 2017-2019, U.S. production, by volume, of fresh fruit and vegetables changed little, while imports of fresh fruit increased by 129% and fresh vegetables by 155%.

Some fresh fruit and vegetable commodities grown in the U.S. today are more at risk of being displaced by imports than others. The U.S. International Trade Commission opened an investigation in 2020 to look into reports from U.S. growers of blueberries in Florida and Georgia that high import volumes of fresh blueberries were causing financial harm to the domestic industry.

The largest U.S. firms also have growing operations abroad and may view strong U.S. demand for their fruits and vegetables as an economic opportunity. By growing the same crops in Mexico, these U.S. producers can supplement their domestic production with imports and fulfill contractual obligations year-round. By establishing farms in Mexico, these growers protect against potential losses from disease and weather events. Similar strategies have been observed among the largest strawberry growers.

Strategy 2: Using Machines To Generate Faster and More Efficient Work During Harvest

Mechanization has a long history in U.S. agriculture. Most field crops are exclusively planted, tended, harvested, and processed by machines. However, it is more difficult to mechanize many tasks in fruit and vegetable farming.

Fruit and vegetable commodities fall along a spectrum varying from easier to harder to mechanize. Commodities that fall along the easier to mechanize end of the spectrum are already largely harvested by machine. Such commodities include tomatoes and blueberries for the processing market, and tart cherries in Michigan. Along the harder-to-mechanize end of the spectrum are commodities for which few or no viable harvest machines are available such as fresh field tomatoes, iceberg lettuce, and strawberries.

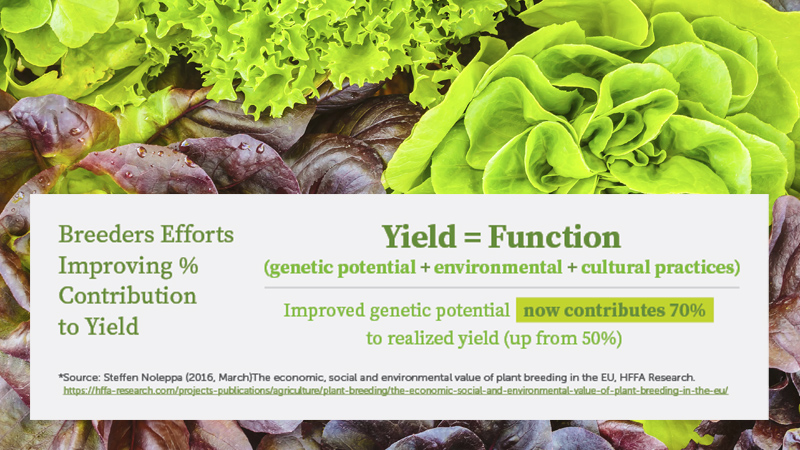

Creating mechanical harvesters requires advanced engineering and extensive trial and error. Breeders and plant scientists must work with engineers to develop plant varieties and technologies that work in concert. Their goals tend to be mutually exclusive, however, as engineers seek efficiency, while growers seek to preserve fruit quality and flavor.

Strategy 3: Employing More Guestworkers Under the H-2A Program

Agricultural employers unable to find sufficient help to meet their labor needs may opt to hire foreign workers under short-term contracts on guest visas known as H-2A.

It generally costs more to employ H-2A workers than it does to hire their domestic counterparts. Program rules require the employer to pay a special wage known as the adverse effect wage rate (AEWR), provide housing, and provide transportation from and back to the guestworker’s country of origin. The DOL sets the adverse effect wage rate each year for 15 regions and three states using data from the USDA’s Farm Labor Survey. The AEWR, which nearly always exceeds the state, federal, and local prevailing wage rates, is one of the more controversial aspects of the program among employers.

Research shows the share of H-2A workers among all crop workers is increasing. H-2A workers are estimated to make up about 10% of the nation’s crop workers. Growth in the program has been observed across all states over the last decade, suggesting that despite the higher wage rate and additional costs of employing workers through the program, producers are turning more often to H-2A guestworkers for their labor needs.

To access the entire report, visit ers.usda.gov.