Industry Experts Say Prospects Still Looking up for Almond Growers

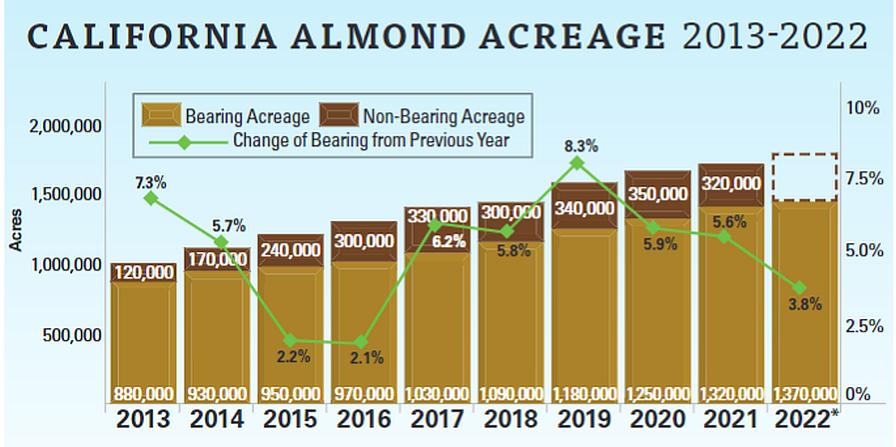

Growth of the California almond industry over the past decade has been astounding. During that period, the state added 490,000 acres of almonds, more than the total acres of land in the entire U.S. for growing apples, 382,000 acres.

Source: USDA Agricultural Statistics Ser vice, Pacific Region (NASS/PR) 2021 Acreage Report Estimate *Non-bearing acreage for 2022 available April 2023

Almond growers have had a season akin to that of a highly successful football team that’s sustained all sorts of injuries and is headed for a rough record. But once the players heal, the foundation that produced past championship teams remains, and they are poised for a comeback.

Farming isn’t the same as football, though, and change generally doesn’t come nearly as quickly. But listening to experts in a variety of fields at The Almond Conference this past December, the change will come, and it should prove a winning formula for U.S. growers. They have two things going for them any team would envy — the best facilities, and the prospect of lots of fans heading through the turnstiles.

GROWING FAN BASE

The “fans” are the huge numbers of consumers around the world who continue to grow. At the conference’s annual State of the Industry, David Magaña, Rabobank Senior Analyst – Horticulture, said the world will continue to develop a huge middle class, much of it in Asia. With newfound wealth, such people often want to consume pricier foods, such as crops exported from other countries. That’s a sweet spot for U.S. almond growers, who export about 70% or their crop.

“Feeding a growing population with increasing incomes not only demands more food, but a lot of the types of food we grow in California, such as almonds,” he said.

The success of exports, or perhaps more accurately, their predicted success in the future because of a burgeoning global middle class, means we will see more planting of such crops in the future. The planting trends over the last five years of the past decade in California are revealing, showing both an emphasis on exports and the state’s lack of water.

Only one significant so-called permanent crop, grapes, did not see increased planting between 2015 and 2020. Planting of almonds, pistachios, and walnuts all shot up during that period, while crops such as hay, corn, tomatoes, wheat, and cotton all dropped, some significantly. As more restrictions are put into place, water is expected to continue to flow away from such crops and toward fruit, nuts, and certain vegetables.

TOP-NOTCH FACILITIES

The other factor is very much a product of their past success. Almond growers have built an industry in California that dwarfs any of the others around the world. To get an accurate picture of the immensity of the industry growers have built in the Golden State, it helps to go away for a few years and work in one of the world’s few almond production regions.

In a conference session on global tree nut production, David Doll spoke of his experience working as General Manager of Rota Unica Portugal. Doll, a former University of California Farm Advisor who’s perhaps best known for his insightful blog, “The Almond Doctor,” left California to take the job on the Iberian Peninsula several years ago. That region was the world’s largest until growers began planting in California and is now dwarfed by the Golden State.

The U.S. produced 41% of the world’s tree nuts from 2017-2022, the lion’s share of that from California. To put that dominance in perspective, the production of the second-place region, China, was less than one-fourth that of the U.S.

Doll highlighted how California almond growers have built an immense industry over the past few decades — replete with all the attendant handling the nuts require, from shaking and sweeping, to hulling and processing — that is unparalleled. Doll said after his experiences overseas he was more impressed with the California industry than ever.

“Remember that,” he told grower-attendees as the session closed. “You have an infrastructure here found nowhere else in the world. You are 20 to 30 years ahead.”